About

The UK’s leading dental manufacturing group

ALS Dental was created in 2019 by Ansor LLP partners Peter Strafford and Peter Marson. They identified that the dental laboratory industry was on the cusp of transformation with the potential to improve products and solutions for dentists and patients whilst delivering significant growth and value by building a large dental laboratory group.

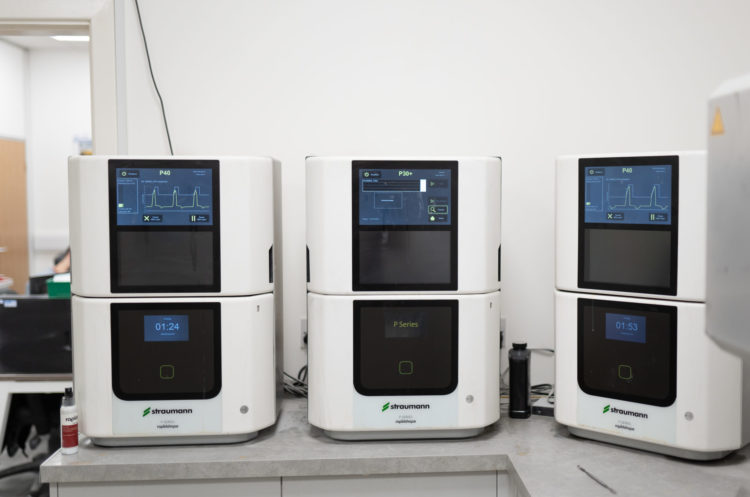

Dental manufacturing is undergoing a rapid transformation from a fragmented industry of small laboratories staffed by experienced dental technicians manufacturing crowns, bridges, implants and other dental products by hand to a world of digital workflows and large-scale automated production involving intra-oral scanning, 3D printing and robotics.

ALS aims to establish itself as the UK’s foremost dental manufacturing group, distinguished by innovation and technological excellence. The company seeks to revolutionize the industry by integrating forward-thinking businesses, cutting-edge technologies, and highly skilled professionals.

Under the leadership of CEO Tom Lavery, previously Managing Director and Chairman of Johnson & Johnson Medical UK & Ireland, and CFO Kenny Burns, ALS is expanding its presence across the UK with plans to enter the international laboratory market.

Since its launch in late 2019, ALS has rapidly grown through acquisitions and organic development in the crown and bridge and orthodontic sectors, with a strong pipeline fueling ongoing expansion.

Our Investors: Ansor LLP

ALS Dental is wholly owned by London based private equity firm Ansor. Ansor LLP was established by Ed Ainsworth, Peter Marson and Peter Strafford to continue their successful strategy of investing in small and medium sized companies in growing, fragmented sectors. The founding partner team have a long and successful track record over their careers of establishing and acquiring UK SMEs and delivering attractive investment returns.

Ansor seeks to create value from the acquisition of profitable SMEs and combining them into large, higher value platform businesses. Ansor has completed a significant number of acquisitions and invests heavily in organic growth and so achieve real focus and can affect transformational development.

Ansor provides the opportunity and professional environment for international institutions to invest in the private small cap sector. They have a proven operational methodology and have operated successfully in this space for over a decade. Ansor provides the necessary capabilities, experience and governance to source, acquire and develop companies in the high growth small and medium sized company sector, aiming to deliver attractive investment returns.

Ansor has a strong commitment to sustainability. All of their portfolio companies operate in sectors where they are able to make a positive contribution to the environment. Ansor is a signatory to the UN Principles of Responsible Investment and all portfolio company platforms follow and continually refine ESG principles.